For instructions on how to add True North Disability Services as an authorized representative, please click here.

How do I complete this form?

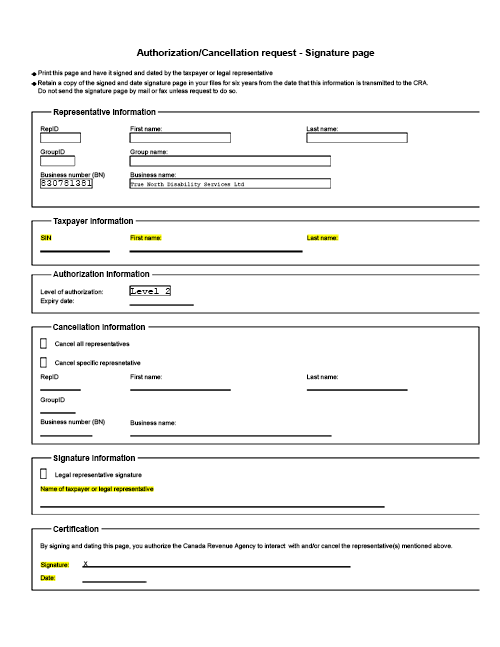

Please fill in your social insurance number (SIN), First Name, and Last Name. Please print your full name where asked, date, and sign.

Download the Authorization Form here.