How does True North Disability Services help? Our team works with Canadians suffering from countless types of medical conditions to help determine if they may be eligible for the Disability Tax Credit (DTC). If we feel a client’s condition meets the criteria for eligibility, we will work with them to complete the necessary documents and promptly process the claim. Count on our thorough and focused process. We gather information on medical history and day to day life, understanding how specific conditions impact quality of life. We also access current and previous tax information. We then prepare all of the documents required for DTC approval, and submit them on behalf of our client to the Canada Revenue Agency. Our approach is designed to simplify the overall process. And our expert understanding of how to properly present your case to the CRA ensures the best chance of receiving the maximum benefits! Once a client is DTC certified, there are numerous programs available that will aid them in achieving future financial stability. Want to learn more about the Disability Tax Credit? Contact Us today!

Why do you complete a tax assessment? The Disability Tax Credit is a non-refundable tax credit, meaning your refund is based on your taxable income of up to the last 10 years. By completing a full 10 year tax assessment, this allows us to ensure you have not only had sufficient income to claim the credit and receive a refund, this also allows us to identify any years with low/no income so that we may make recommendations on transferring any of your unused credits. In many cases, unused credits can be transferred to a supporting family/member or spouse, which maximizes the return in which you and your family may receive.

Are you already claiming the Disability Tax Credit? Many clients have come to us that are currently eligible, but did not fully take advantage of the credit and the ability to transfer any of your unused credits. We are happy to complete an assessment to ensure that nothing has been missed, and you are receiving the entire benefits you are entitled to.

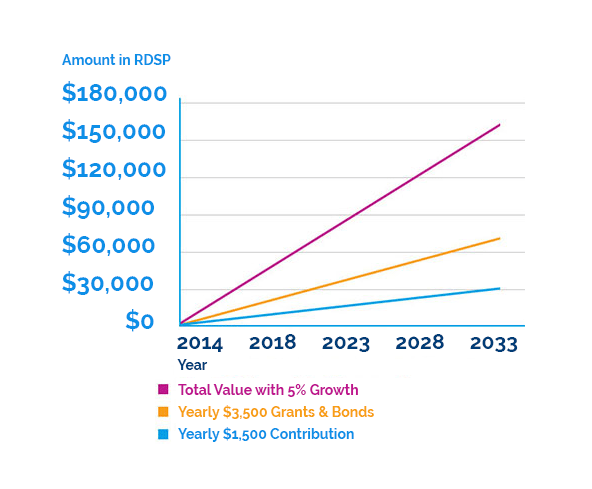

What is the Registered Disability Savings Plan? Qualifying for the Disability Tax Credit (DTC) is the benchmark in obtaining access to the Registered Disability Savings Plan, often referred to as the path to prosperity. But in order to open an RDSP, you MUST first qualify for the DTC. While we are not financial advisors or brokers, we have well-established relationships with professionals who are highly experienced in opening and managing RDSP accounts. They would be more than happy to assist you. If you have your own financial advisor, please ask them about this program and get started right away! Discover a more prosperous future. One of our goals at True North Disability Services to properly educate our valued clients on the benefits and financial possibilities an RDSP account provides. For example, if individuals with household incomes between $43,953 and $87,909 invest $1500 per year for 20 years, their RDSP account would grow to $165,000! (Based on a standard 5% projected rate growth on the investment account—all tax free while in the account). The chart below demonstrates the returns you may receive.

Want to learn more about a Registered Disability Savings Plan? Contact Us today!