Wondering if ankylosing spondylitis is considered a disability in Canada? Here’s everything you need to know.

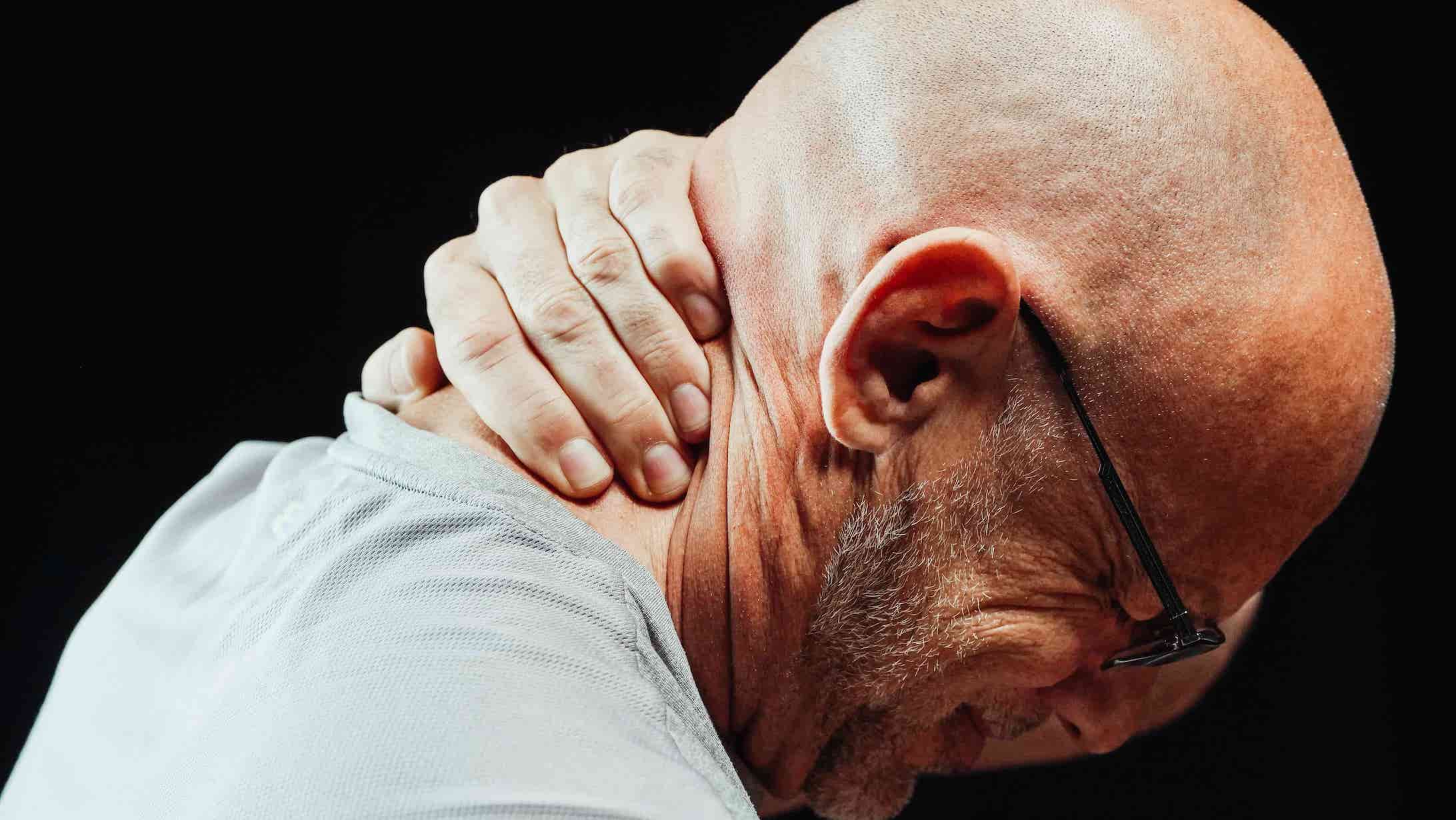

It’s estimated that 300,000 Canadians live with ankylosing spondylitis. This lifelong inflammatory autoimmune disease is a form of spondyloarthritis, which may cause chronic back pain, neck pain, and stiffness.

But, could ankylosing spondylitis pain get serious enough to severely limit and impact an individual's life? Is ankylosing spondylitis a disability? Could those with ankylosing spondylitis qualify for disability programs in Canada?

In this article, we will answer these questions and share everything you should know about ankylosing spondylitis and disability recognition and benefits in Canada.

Ankylosing spondylitis is a form of inflammatory arthritis, a variation of spondyloarthritis.

This condition primarily impacts the spine and the sacroiliac joints, where the pelvis meets the spine. Those living with ankylosing spondylitis may deal with chronic back pain, neck pain, and stiffness in the lower back and hips.

But, ankylosing spondylitis is far more complicated than a bit of back aches and pains.

“Ankylosing” means fusing and “spondylitis” means inflammation of the spine.

While ankylosing spondylitis is a form of inflammatory arthritis, it is also a recognized autoimmune disease. With ankylosing spondylitis, the body’s immune system targets and attacks the ligaments and tendons connected to the spine. When this damage occurs the bone can begin to erode, in an effort to repair itself, the body forms new bone. While this doesn’t always occur, this bone growth may cause the bones of the spine to fuse together, causing the spinal cord to become inflexible, stiff, and painful.

Those with this lifelong condition may experience a range of impacts and potential impairments. For some, ankylosing spondylitis only causes them minor pain that may come and go. For many, treatment is effective at reducing symptoms and flare-ups. The majority of people with ankylosing spondylitis live perfectly normal and full lives.

For others, ankylosing spondylitis can progress in severity and may experience spinal fusion. This severity doesn’t always happen with ankylosing spondylitis. However, in these cases, ankylosing spondylitis may very well be viewed as an impairment.

Yes, ankylosing spondylitis can be a disability in Canada. However, the diagnosis itself does not automatically qualify as a disability.

When it comes to disability recognition from the Canadian government, it’s a bit trickier than simply having a diagnosis. This is because people with the same condition are affected to varying degrees.

That being said, if the tasks of everyday life are affected by your ankylosing spondylitis, your condition may be considered disabling.

Ankylosing spondylitis may affect your ability to carry out daily activities like walking, doing daily chores, dressing, and working for long periods of time.

When it comes to the Disability Tax Credit, Canadians can get approved under the following categories: walking, feeding, dressing, speaking, seeing, elimination, mental functions necessary for everyday life, vision, and life-sustaining therapy. Some of which may be affected by ankylosing spondylitis and other inflammatory arthritis conditions.

If you’re wondering if ankylosing spondylitis is a disability in Canada or if you could qualify for life-changing benefits like Disability Tax Credit – ask yourself these questions:

If you answered yes to any of these questions, you may qualify for the Disability Tax Credit. To know for sure, reach out to us for a consultation.

If you or a loved one is affected by ankylosing spondylitis and experiences challenges in walking or dressing, you might be entitled to a substantial refund from the Canadian Government.

The Disability Tax Credit may allow you to retroactively claim for up to the past 10 years, potentially leading to a significant payout of up to $40,000.

Designed for Canadian taxpayers with a disability, the Disability Tax Credit is a non-refundable tax credit. (Meaning, your refund is based on your taxable income or that of a supporting family member/spouse). The program was designed to provide financial relief for individuals with disabilities and their families.

Once an individual is DTC-certified, they may become eligible for a Registered Disability Savings Plan (RDSP). This program offers up to $90,000 in grants and bonds, serving as an exceptional resource for retirement planning.

Here at True North Disability Services, we specialize in helping Canadians with eligible conditions qualify for the Disability Tax Credit. We are dedicated to helping Canadians claim the benefits they are entitled to.

Why are we so passionate about helping people? It all begins with our story.

Want to know if you would qualify for the Disability Tax Credit and uncover years of retroactive claims? Reach out to us, totally free and risk-free. We’re here to help.