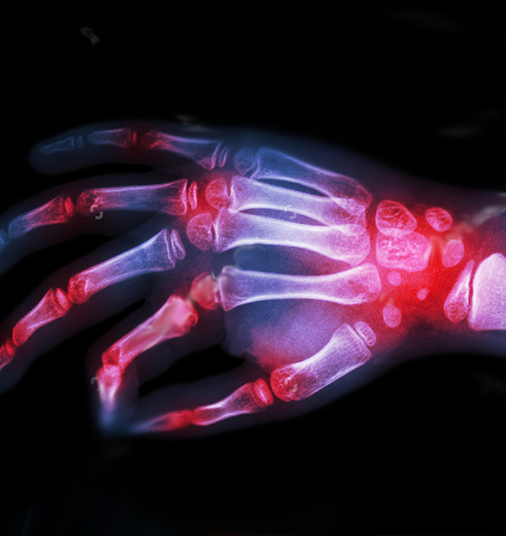

Rheumatoid arthritis (RA) is the most common type of autoimmune arthritis, and is a progressive disease that causes unwanted inflammation in the joints. It is triggered by a faulty immune system (the body’s defense system), and inflammation results in a painful deformity and immobility in, most commonly, fingers, wrists, feet and ankles. Rheumatoid Arthritis is mainly diagnosed in middle-aged or elderly individuals. Studies show that people who receive early treatment for RA feel better sooner and more often, and are more likely to lead an active life. They also are less likely to have the type of joint damage that leads to joint replacement.

Those suffering from rheumatoid arthritis will also experience joint stiffness, swelling, tenderness and loss of rang or motion. Some individuals will also experience fatigue and pain while performing daily tasks.

There are a number of ways that one can qualify for the Disability Tax Credit. Typically, people with Rheumatoid Arthritis may qualify under either Walking or Dressing. If you are taking longer than the average person to perform either of these activities of daily living, you may in fact have a case.

If you or someone you care for suffers from rheumatoid arthritis, you may be eligible for a large refund from the Canada Revenue Agency through the Disability Tax Credit program. We are Disability Tax Credit experts and have experience working with thousands of Canadians with a multitude of medical conditions. We would be happy to discuss your specific case with you and help determine if you may be eligible to claim the Disability Tax Credit, and receive a refund from the Canada Revenue Agency. Contact Us Today!