Is fibromyalgia a disability in Canada? Could you qualify for benefits? Here’s what you should know.

If you’re among the 1 million Canadians affected by fibromyalgia then you know how this mysterious condition can affect your everyday life. But is fibromyalgia a disability in Canada?

In this article, we will help you understand fibromyalgia as a disability in Canada and explore the potential for qualifying for support.

Fibromyalgia is a musculoskeletal syndrome disorder characterized by chronic pain, fatigue, nerve pain, sleep disturbances, and stiffness in joints. It may also impact gastrointestinal health and cause cognitive issues, such as brain fog, headaches, migraines, memory problems, depression, and anxiety.

The exact cause remains unknown. But psychological stress is thought to be a trigger, with those who have experienced PTSD, C-PTSD, or significant emotional stress at higher risk. Women are twice as likely as men to develop fibromyalgia, with 75 - 90% of diagnoses being female.

While there is no cure, various lifestyle, and pharmaceutical interventions may help alleviate symptoms, and stress management may reduce flare-ups.

A disability is generally defined as "an impairment that limits one or more major life activities such as walking, standing, dressing, lifting, or concentrating." These limitations may affect one's ability to work or perform self-care tasks to varying degrees.

When it comes to the Disability Tax Credit, Canadians can get approved under the following categories: Walking, Feeding, Dressing, Speaking, Hearing, Elimination, Mental Functions Necessary for Everyday Life, Vision, and Life-Sustaining Therapy.

The most common disabilities in Canada fall into the categories of pain, mobility, and flexibility - all of which can be experienced by individuals with fibromyalgia.

Fibromyalgia is indeed considered a disability in Canada. In fact, fibromyalgia is the second most common condition among Canadians who cannot work due to a medical condition.

While fibromyalgia is considered a disability in Canada, qualifying for benefits goes far beyond diagnosis.

Simply put, to qualify for disability benefits in Canada such as the Disability Tax Credit (DTC) a condition such as fibromyalgia must be deemed “severe enough” to affect certain aspects of everyday life.

As we mentioned, fibromyalgia can complicate many aspects of life. And if a medical condition affects your ability to carry out everyday activities such as walking, dressing, and standing, then you may qualify for disability benefits such as DTC.

When it comes to the Disability Tax Credit the Canadian government is often focused on the time it may take to complete simple tasks as compared to those who do not have disabilities.

To figure out if you may qualify, ask yourself these questions:

If you answered yes to any of these questions, you may qualify for disability services in Canada.

The Disability Tax Credit is a non-refundable tax credit that can reduce your taxable income, and if you have been living with a disability for a while, you might be eligible for a retroactive tax credit. (Retroactive for up to 10 years if you qualify.)

Depending on the duration of your condition, you could potentially receive a refund of up to $40,000 from the CRA. We help thousands of people every year get the support they deserve.

You can read more on some DTC FAQs here to learn more.

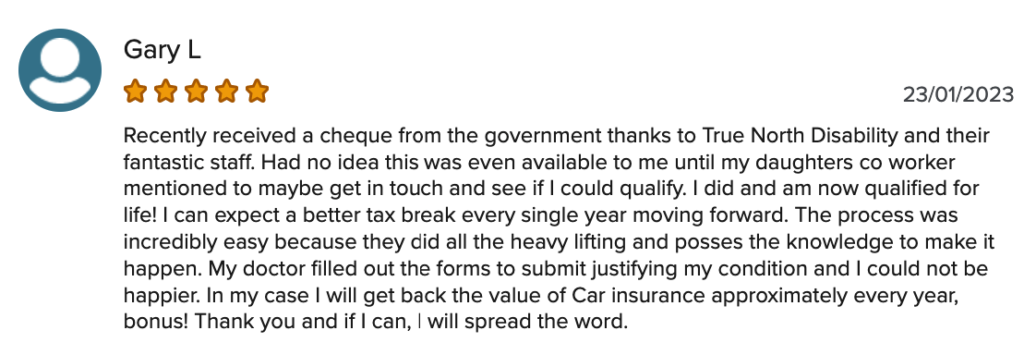

Our team of DTC specialists at True North Disability Services works tirelessly to secure the maximum benefits for our clients. We collaborate with clients to complete the required paperwork and expedite the claim process.

Many individuals who apply for the DTC on their own are denied benefits for various reasons, but working with a team of experts can significantly increase approval rates.

To learn more about the Disability Tax Credit, don't hesitate to contact us today! There is no cost or risk to submitting your application through True North Disability Services.

Click here to set up a DTC consultation.

Click here to explore our refund estimating calculator.

Fibromyalgia is considered a disability in Canada, and those with the condition may qualify for the DTC if their symptoms significantly impact their daily life. DTC can reduce taxable income, and individuals with fibromyalgia may be eligible for a retroactive tax credit, potentially receiving a refund of up to $40,000.

If you or someone you know is affected by fibromyalgia and you're wondering whether you qualify for disability benefits in Canada, don't hesitate to reach out to our team. We’re here to help.

Helpful quick links: